How to Become a CPA (Free Student Guide and Poster)

Many teenagers who are not quite sure what they want to do take business courses, and that’s for good reason. There are a wide variety of jobs in the business area, and one of the best jobs may be a CPA (Certified Public Officer). This field is big, always growing, and there are many opportunities to open now and in the future. This is the way to become a CPA, including answers to frequently asked questions and helpful suggestions for successful people in the field.

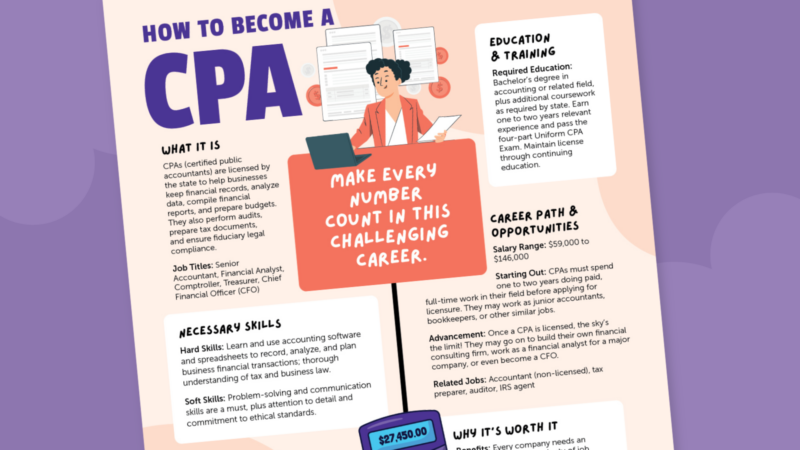

Free poster

“How to Be a CPA” poster

Grab this free printable poster and hang it in your classroom or career consultant office!

How to Become a CPA FAQ

What is CPA?

Certified public accountants, often shortened to CPAs, are the people who work with businesses to help them manage their financial transactions. They keep records, analyze data, compile financial reports and create budgets. The CPA also conducts audits, prepares tax documents and ensures compliance with the trust laws for the business.

CPA is different from regular accountants: After completing specific educational requirements and licensing exams, their working status has been licensed. Obtaining this certification enables employers to know that potential employees are eligible for all important accounting tasks. The CPA completes the continuing education requirement to maintain its license throughout its career.

Why become a CPA?

“Two words: unlimited potential. Everyone needs a CPA, from a public accounting firm to your favorite sports franchises.” CPA Ed Duarte is the chief financial officer of Miami’s foreign parts distributor and the current chairman of the FICPA board of directors. He is passionate about his field and encourages every high school student to consider its amazing possibilities.

“First of all, there is always a high demand for our services, providing us with built-in job stability,” Duarte explained. “Companies and businesses in all industries need CPAs for financial reporting, tax compliance, strategic consulting and more. Whether in public accounting, corporate finance, government, government or non-profit, CPA can work anywhere and need to work anywhere. We are trusted consultants, and these three letters – CPA-CPA-CPA-Carry Prestige.”

What is the average salary of a CPA?

As Duarte points out, one of the biggest advantages of being a CPA is that these accountants tend to earn more salaries than uncertified accountants. In the United States, the average CPA earns about $93,000 per year. (Salary ranges from $59K to $146K). By comparison, uncertified accountants earn an average of $65,000 per year. That’s a big difference!

*Note: As of February 2025, salary information is indeed every time.

What does CPA do every day?

Much more than you think! Duarte shared: “I want to say there is no typical day, and for me it’s an exciting part of the industry. Every day is a different experience. One day, I’m closing financial records. One night, I have dinner with colleagues and clients. The next day, I travel.”

He continued: “There may be a certain idea of an accountant, but it’s a really exciting moment to be a CPA. Yes, I’m reviewing emails, answering calls, doing the basics of work. But when you shrink, what I really do is problematic is that I’m going to work hard on these numbers, play these numbers on these numbers and draw them in a certain process, and reward them in a certain process, and win an important thing. You’ll become more experienced and work gets bigger and bigger, so time management, communication and teamwork are really important skills.”

What are the necessary skills for CPA?

“Accounting is the language of business, but not just math,” Duarte stressed. “There are all kinds of skills necessary to succeed in a career from problem solving to communication. You’re not only adding and subtracting. You’re using these numbers to tell a fascinating story – business owners, investors and boards. And human touch, which is crucial for an effective CPA.”

A good CPA also needs to be satisfied with existing and emerging technologies. “Digital transformation is rapidly developing our careers,” Duarte explained. “CPA is now at the forefront of data analytics, financial automation, artificial intelligence and robotics processing. Embracing technology will keep our careers both lagging behind (what happened?) and what will happen? What will happen?

Does CPA require a degree?

Yes. Most people earn a bachelor’s degree in accounting or related fields. Each state has its own requirements for the number and type of courses that must be taken in both accounting and general business.

How to Become a CPA: An Overview of the Process

Important: The CPA has a state license, so the requirements may vary. Contact your state’s licensing board for the most accurate and up-to-date information.

Obtain a bachelor’s degree

The most common way to start your journey to becoming a CPA is to earn a bachelor’s degree in accounting or a closely related field. During college, you have to spend specific course time in accounting and general business. These include topics such as taxation, auditing and commercial law.

Most states require at least 150 hours of college courses to become a CPA. Since many college degrees only take 120 hours to graduate, potential CPAs may need to take other courses to bridge the gap. To ensure you meet your educational requirements, choose a school that offers programs specifically for future CPAs.

Pass the unified CPA exam

The unified CPA inspection consists of four parts. All candidates must accept and pass Audit and Certification (AUD), Financial Accounting and Reporting (FAR), and Taxes and Regulations (REG).

For the last section, candidates choose one of three options: Business Analysis and Reporting (BAR), Information Systems and Control (ISC), or Tax Compliance and Planning (TCP).

You must get a score of at least 75 points in each section to pass the entire exam. Most statuses allow you to take each part of the exam separately, and if you need to reassign certain parts, you can have some flexibility.

Gain relevant work experience

States usually require potential CPAs to earn work experience in their field (usually one to two years of full-time paid jobs) before applying for a permit. You can start when you earn a bachelor’s degree by completing an internship or choosing to earn a summer job that provides accounting experience.

Maintain certification through continuing education

Once you have obtained a CPA license, it must be maintained through a continuing education course. This allows you to keep your field progressing and changing and stay sharp throughout your career. Each state has its own continuing education requirements; connect with you to learn what you need.

Don’t forget to catch you as a CPA printable poster for free!