These major foundations’ money myth activities are fun

Money can be a complex topic. Many times, we avoid discussing money and finances because it is stressful, uncomfortable, and even confusing. In fact, recent research tells us that nearly half of millennials and Gen Z think they don’t learn the financial facts of being able to grow, but 70% work in a job before they are 19 years old.

Our young people need and deserve more. With so much common misinformation, it is important for students to feel that they are asking questions about financial issues. They should feel comfortable addressing and debunking such as:

- Only the rich need financial advisors.

- You should avoid credit cards.

- Rent is just throwing away money.

- You shouldn’t talk to people about money.

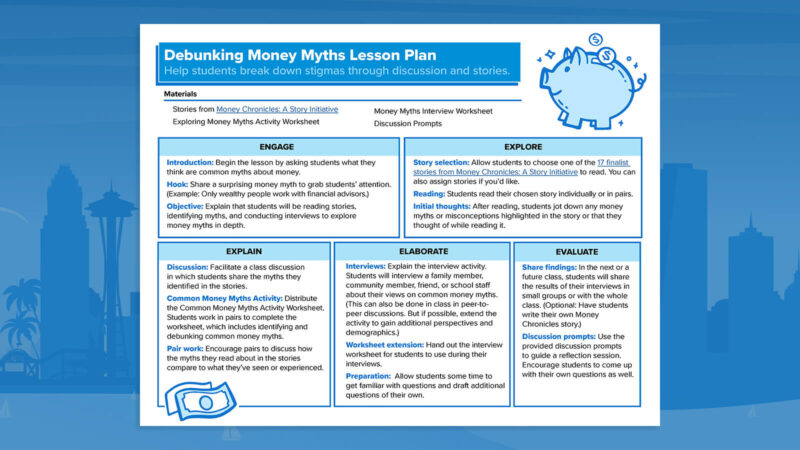

This lesson plan bundle, debunking money myths, will help the authenticity of these and many others by encouraging students to have those challenging conversations. Sign up now to get these free resources and continue reading to learn more.

What is included in the Money Mythology lesson plan

This course plan helps students understand and challenge common financial misunderstandings. Quickly view what’s in it.

- Introduction to the money myth: First discuss the money students hear.

- Read the Money Story: Students read the story of Money Chronicles: Story Initiative, aiming to identify and discuss money myths.

- Deepen the discussion: Students will have conversations between partners and group work to further debunk the myth.

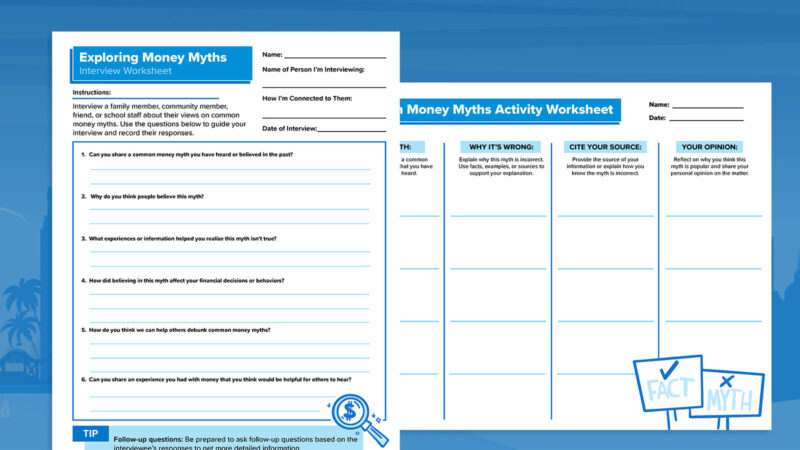

About Money Myth Activities and Worksheets

All courses will be better when there are hands-on components. Take a look at the activities and worksheets included in the lesson plan.

- Determine the extra money myth: This activity will help guide students to identify and debunk money myths. It will give them a voice and encourage critical thinking.

- Use the interview worksheet: Students interviewed family or community members about myths and gained different perspectives.

These tools promote interactive learning, critical thinking and real-world applications, help students build a solid foundation in financial literacy and feel comfortable having conversations about money.

Check out Fenyx Blue’s comments on this program in the video below.